What Are Bad Credit Loans in South Africa?Bad credit loans in South Africa are specifically designed for individuals with a low credit score or a negative credit history.

These loans offer a financial solution for people who may have been rejected by traditional banks due to missed payments, defaults, or high debt-to-income ratios.

They often come with higher interest rates to compensate for the lender’s risk, but they provide access to much-needed funds for emergencies, debt consolidation, or personal use. Whether you’re looking for online bad credit loans or consolidation loans for bad credit, there are many options available tailored to your financial needs.

Online Bad Credit Loans – Fast and Accessible

The most popular option among South Africans with poor credit is online bad credit loans. These are loans offered by digital lenders who use modern algorithms to assess affordability beyond traditional credit scores.

Key Features of Online Bad Credit Loans:

- Quick application process (5–15 minutes)

- Instant pre-approval decisions

- Fast payouts, often within 24 hours

- Minimal documentation required

- Can be unsecured (no collateral)

Pros:

- No need to visit a branch

- Flexible repayment terms

- Available to most employed or self-employed individuals

Cons:

- Higher interest rates

- Penalties for late payments

Popular online lenders in South Africa offering these services include Wonga, Boodle, Lime Loans, and MyLoan.

💸 Personal Loans in South Africa – Loan Amounts, Loan APRs & Loan Terms

South African lenders offer a wide range of personal loans tailored to different financial needs, from emergencies and home improvements to consolidating debt. Here’s a breakdown of typical loan features:

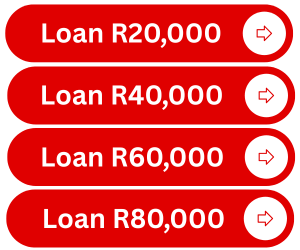

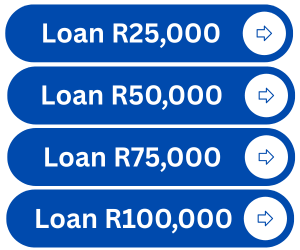

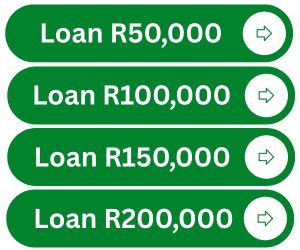

✅ Loan Amounts

- Minimum: R1,000

- Maximum: R350,000 (some banks may offer more for qualified applicants)

The amount you can borrow depends on your income, creditworthiness, and existing debt obligations.

📅 Repayment Terms

- Short-term loans: 1 – 12 months (typically used for payday or microloans)

- Medium-term loans: 12 – 36 months

- Long-term loans: Up to 72 months (6 years), depending on the lender

Most banks and financial institutions allow flexible repayment terms that match your affordability profile.

📊 Interest Rates / APR (Annual Percentage Rate)

- Typical APR range: 15% – 27.75% per annum

(as per regulations by the National Credit Act) - Short-term loans or payday loans: Can have higher effective interest rates, often exceeding 60–100% when annualized

- Debt consolidation and personal loans: Tend to offer more favorable rates if your risk profile is moderate to low

Lenders may also charge initiation fees (up to R1,207.50 for loans above R17,000) and monthly service fees (up to R69), which are included in the APR.

🏦 Examples of Major South African Lenders Offering Personal Loans

| Lender | Loan Amount | Terms | Typical APR |

|---|---|---|---|

| Capitec Bank | R5,000 – R250,000 | 1 – 84 months | From ±13.25% |

| FNB | R1,000 – R360,000 | 1 – 60 months | Variable |

| African Bank | R2,000 – R250,000 | 7 – 72 months | ±15% – 27% |

| Absa | R3,000 – R350,000 | 12 – 84 months | Based on profile |

| WesBank / DirectAxis | R5,000 – R150,000 | 24 – 72 months | 15% and up |

Types of Bad Credit Loans in South Africa

1. Payday Loans for Bad Credit

Payday loans bad credit are short-term loans designed to cover expenses until your next salary. These are ideal for small emergencies like medical bills or car repairs.

- Loan amounts: R500 – R8000

- Repayment: Usually within 30–45 days

- Fast approval, even with a bad credit score

Tip: Always repay payday loans on time to avoid rollovers or being trapped in a debt cycle.

2. Personal Loans for Bad Credit

These are medium- to long-term loans with flexible terms. You can borrow up to R250,000 depending on your affordability.

- Repayment period: 12–72 months

- Ideal for financing large expenses or emergencies

- Requires proof of income and affordability

3. Debt Consolidation Loans for Bad Credit

One of the smartest ways to manage poor credit is by opting for debt consolidation loans. These loans allow you to pay off multiple debts and combine them into a single monthly payment.

Benefits of Consolidation:

- One manageable monthly payment

- Lower overall interest rates (in some cases)

- Reduced stress from multiple creditors

How to Qualify for a Loan with Bad Credit

Even if your credit score is low, lenders will evaluate other factors to assess your ability to repay the loan:

✅ Proof of steady income – through payslips or bank statements

✅ Employment stability – the longer you’ve been employed, the better

✅ Affordability – lenders analyze your debt-to-income ratio

✅ South African ID and active bank account

Some lenders may perform a soft credit check to verify your identity and income level but still approve your application.

Pros and Cons of Loans for Bad Credit

| Pros | Cons |

|---|---|

| Quick access to cash | Higher interest rates |

| Available even with a poor credit score | Potential for over-indebtedness |

| Improves credit score if paid on time | Some lenders charge hidden fees |

| No collateral required | Limited loan amounts |

Frequently Asked Questions (FAQs)

Can I get a loan in South Africa with a credit score below 500?

Yes, some lenders offer online bad credit loans with flexible requirements. Your income and repayment capacity are more important than your score.

Do bad credit loans require collateral?

Most are unsecured, especially payday loans bad credit and smaller personal loans.

Can I apply for debt consolidation loans bad credit online?

Yes, several online lenders and banks like Capitec and African Bank offer this option.

How long does it take to receive the money?

Some lenders pay out the loan within hours of approval, especially if you apply during business hours.

Final Thoughts

Getting a loan with a poor credit score in South Africa is no longer impossible. Thanks to the growth of online bad credit loans and debt consolidation loans bad credit, individuals now have more options to stabilize their financial situation. Just make sure to borrow responsibly, compare your options, and focus on repaying the loan on time to gradually rebuild your credit profile.